Portfolio

Tobi Odukoya

Last Update há 3 anos

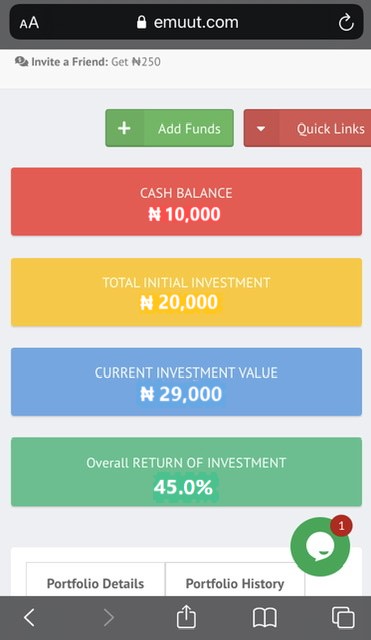

The portfolio is like a personal accountant that gives you information about all investments made whilst trading on Emuut.com. It is a collection of all your trading operations such as; emps purchased, emps sold, cash balance, total initial investment, current investment value, return on investments and also includes information on closed transactions.

The portfolio summary is also shown at the top right of your screen while performing other transactions, so you can monitor your profits as you go from page to page. It shows the total funds you have in your e-Wallet in addition to the value of emps you have. This gives a quick glance at how much you have in the system at any point in time.

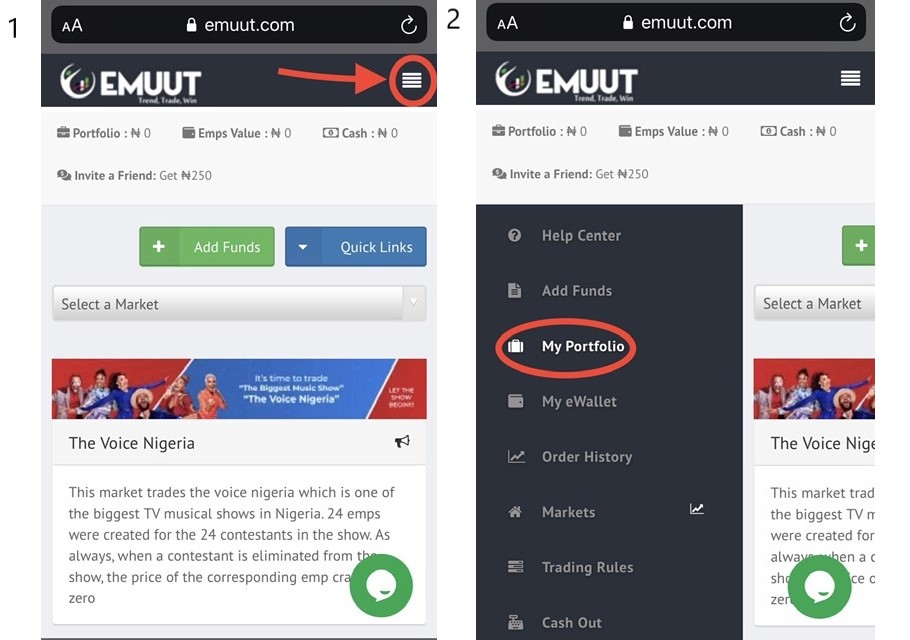

However, to view the full breakdown of information so as to track your investments, you can visit "My Portfolio" from your menu. This is shown in the image below.

Viewing your portfolio will reveal some important information, such as:

1. Cash Balance:

The cash balance is the amount you have available to either purchase emps or the money you gain from selling your emps. In the beginning, it is equivalent to the amount you fund your wallet with (before purchasing emps). This balance is also available to be withdrawn or used to re-invest in emps, after selling your .

2. Total Initial Investment:

The total initial investment is the total amount spent purchasing emps. it is the cost price for making investments.

3. Current Investment Value:

The current investment value is the amount of money your investment has accrued as at that time. It is the total initial investment plus the profit or loss made on your investment.

4. Overall Return of Investment:

The Overall return of investment, more commonly known as the ROI, is your profit or loss on investment expressed as a percentage. A profit will be expressed as a positive percentage (e.g 20% or +20%) while a loss will be expressed as a negative percentage (e.g -3%). To calculate your profit simply input the figures into this formula (ROI x Initial investment)/100